By Andre Hanai, project manager at IDIS, and Paula Gonçalo, project coordinator at IDIS

About 25% of the deaths caused by rain in Brazil in the last 10 years occurred in 2022, and social investors must prepare more than ever for emergencies.

Between January 2013 and April 2022, natural disasters caused losses of R$341.3 billion throughout Brazil, according to data from a survey conducted by the National Confederation of Municipalities (CNM). The study also shows that in just the first three months of 2022, about eight million Brazilians had already been affected by some type of environmental disaster.

Speaking of numbers, another alarming fact on the subject comes from the government transition report released in late December 2022. It shows that the public money reserved for “support for emergency mitigation works for disaster reduction” was reduced from R$2.57 million to a mere R$25,000, becoming one of the budgetary bottlenecks for 2023.

In this context, solidarity has moved individuals and companies around emergency campaigns that seek to help communities most affected by natural disasters through the donation of food, clothing, medicine, etc., with Private Social Investment being a complementary alternative to public resources. The reduced volume of financial resources available and, mainly, the lack of coordination and strategic planning of actions show that there is a huge gap between social demands and the capacity of private social investors to respond to these tragedies, which increase in frequency and severity every year.

By definition, according to the ISDR – International Strategy for Disaster Reduction, a “disaster” is a “serious disruption of the functioning of a community or society, with impacts on people, goods, economy, and the environment, that exceeds the capacity of those affected to deal with the situation through the use of their resources.” The Covid-19 pandemic, a disaster of global proportions, has revealed the important role that companies can play in efforts to address emergencies, for example.

According to the 2020 Corporate Giving Ranking produced by IDIS – Institute for the Development of Social Investment, the ten companies that made the most donations and sponsorships in the world in 2020 allocated more than US$4 billion to Covid-19 response actions – equivalent to about R$20 billion. Meanwhile, in Brazil, the top ten corporate donors have given more than R$3 billion to the fight against the pandemic.

Floods in the State of Bahia in December 2021. Photo: Isac Nóbrega/PR

On the other hand, these numbers contrast with what had been observed as a trend in private social investment by companies focused on situations caused by disasters. According to the study Measuring the State of Disaster Philanthropy, conducted by Candid & Center for Disaster Philanthropy in 2019, although 70% of companies reported that disaster response is significant, the amount allocated to this type of action has been decreasing year by year, demonstrating that companies see this type of philanthropy as not very strategic.

The same study shows that philanthropy and private social investment could be more strategic. More than half of the resources aimed at emergencies are directed toward immediate response and relief of the initial shock caused by the disaster. At the same time, only 20% of donations support communities in becoming more resilient, promoting risk reduction and mitigation, and preparedness and readiness for emergencies.

The study “A purpose-action Framework for Corporate Social Responsibility in Times of Shock”, developed by Francisco Javier Forcadell and Elisa Aracil, corroborates these data. It analyzed the performance of 218 companies in Spain during the first weeks of Covid-19 in the country and classified them into 4 categories (symbolic, selective, reactive, and supportive), based on the company’s performance in the two main dimensions considered critical to the effectiveness of corporate interventions in emergencies: the scope of the intervention and response time.

Companies classified as symbolic or reactive have a very slow response time but differ in the scope of their actions, with the symbolic being quite restricted and the reactive being quite broad, with a greater sense of social responsibility. The selective and supportive classifications categorize companies with a quick response time to emergencies. The selective is restricted in terms of the scope of intervention, generally preferring to act only when there is an immediate need for support, while the supportive looks broadly at the scope of intervention, allowing for greater flexibility and fostering proactivity and innovation. According to the research, 42% of companies had a “selective” performance, meaning they acted quickly but with a significantly reduced scope and less strategic approach, limiting the potential impact of actions on the beneficiary public.

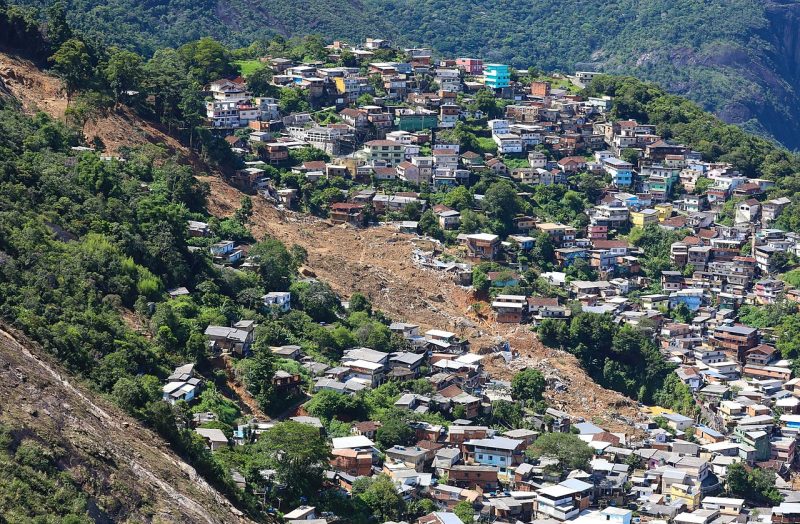

The City of Petrópolis in February 2022 after landslides | Photo: Clauber Cleber Caetano / PR

Companies must broaden their view of emergencies, rethinking their private social investment strategy to support society. There is room for greater impact in the medium and long term, not only to assist communities in times of tragedy but also to seek their resilience and preparedness to face these tragedies, as well as their recovery and reconstruction. To do so, companies need to ensure clear structures, policies, and governance that operate quickly in emergency cases, ensuring that actions are effective and response times are shorter.

It is a fact that we must act to prevent the disastrous consequences of floods, collapses, or fires. But it is also a fact that they will come, and will have disastrous consequences in the lives of thousands of people. Are you prepared to do your part?