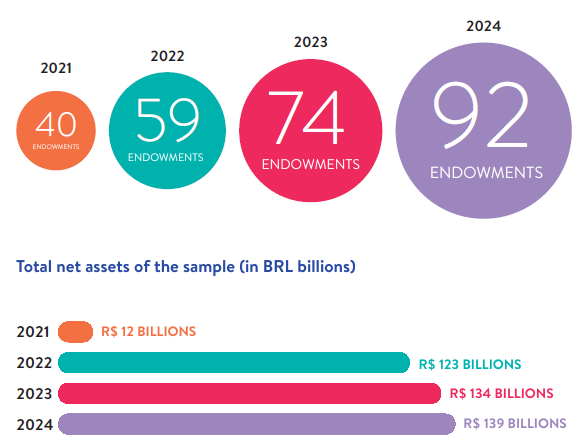

Endowments are stronger than ever in Brazil. This is what the 2024 Endowment Performance Yearbook shows, launched by IDIS – Institute for the Development of Social Investment – and the Coalition for Philanthropic Endowments. With 92 participating funds and BRL 139 billion (approximately USD 25.3 billion) in total assets, the study indicates the consolidation of these structures as instruments of sustainability for causes and organizations in the country. Lawyer and professor Heleno Torres, Head of the Department of Economic, Financial and Tax Law at the University of São Paulo Law School, wrote the foreword.

“In a context of consolidation of endowment in Brazil, the Yearbook’s historical data series from 2019 offers parameters to support managers’ decision-making”, says Andrea Hanai, IDIS project manager.

From the management of an accumulated asset base, only the earnings are used to fund social, environmental, cultural, scientific, or educational projects, ensuring the continuity of initiatives. According to the Yearbook, the main cause supported by the Brazilian funds is education (63%), followed by research and knowledge (27%) and social assistance (23%).

The fourth edition of the publication presents information on cash flow, allocation, returns, responsible investment policy and governance. The figures show growth in fundraising (BRL 770 million – approximately USD 140 million, +48% vs. 2023), BRL 2.6 billion (approximately USD 473 million) allocated to causes, and advances in governance, with 77% of funds having formalized investment policies and 71% undergoing external audits.

However, challenges remain: more than 80% of endowments are concentrated in only two states of the country – São Paulo e Rio de Janeiro, and diversity in boards are quite low.

The fourth edition of the publication reinforces the importance of endowments as drivers of long-term impact and was made possible with Master support from Fundação Bradesco, Fundação Itaú and Movimento Bem Maior, as well as support from 1618 Investimentos, ASA – Associação Santo Agostinho, Fundação Grupo Volkswagen, Fundação José Luiz Setúbal, Fundação Maria Cecília Souto Vidigal, Mattos Filho, Pragma Gestão de Patrimônio and Wright Capital Wealth Management.

EXECUTIVE SUMMARY

Drawing on information from 92 endowments, the 2024 Endowment Performance Yearbook presents a portrait of the field based on a significant sample that is 24% larger than in the previous edition. Bringing together a six-year historical data series (2019–2024), the survey confirms trends and introduces new insights.

With the aim of offering not only a snapshot of endowment funds in Brazil, but also a reference point for managers, in some cases the analyses were carried out by grouping endowments according to their asset size:

– Bracket 1: assets below BRL 10 million

– Bracket 2: assets from BRL 10 to 100 million

– Bracket 3: assets from BRL 100 to 500 million

– Bracket 4: assets above BRL 500 million

This executive summary presents the key highlights.

1. Sample Profile

– Record number of participants: 92 funds, representing 76% of the mapped universe (121 funds as of Dec 2024).

– Total assets of BRL 139 billion — almost 12 times the amount reported in the 2021 Yearbook.

– Prevalence of small and medium-sized funds (76% up to BRL 100 million).

– Strong geographic concentration: São Paulo and Rio de Janeiro host more than 80% of funds; no responses from the Northeast region.

– Majority established without an initial lump-sum contribution and with ongoing fundraising (46.7%).

– Accelerated expansion after Law 13.800, from 2019, with new funds concentrated in the smaller brackets.

– Low formal adherence to Law 13.800/19: only 22% are structured under this framework, despite the regulatory milestone already in place.

– Beneficiaries: 47% of funds support the managing institution itself; education is the predominant cause (63%).

– Still marginal participation in the budget of supported institutions — for most, the endowment accounts for less than 10% of revenues.

2. Cash Flow

– Fundraising on the rise: BRL 770.4 million in 2024 (+48% vs. 2023).

– Extreme concentration: Top 5 funds receive 79% of donations; Top 10, more than 91%.

– Average adjusted donation rate stable in 2024 (12.8%), but with strong disparities across brackets.

– Redemptions increasing: BRL 2.8 billion in 2024 (+33% vs. 2023).

– Most redemptions are directed to causes (92%), with only 8% covering overhead.

– Efficiency rises with size: larger funds direct more than 90% to causes; smaller funds, 44%.

– Average redemption rates are higher among smaller funds (19.8% mean, 4% median) — indicating some aggressive redemption behaviors.

– Redemption rules: predominance of “real-return” rules (45%); more sophisticated rules, such as the Yale model, are still incipient (5 funds).

– Compliance with redemption rules is high (87%), but 13% failed to comply, generally those using real-return rules.

3. Financial Management

– Return targets: only 47% of funds have explicit targets; the majority still operate without them.

– Benchmark basis: IPCA (consumer inflation index) predominates (71%), reflecting a focus on preserving the real value of assets.

– Achievement of targets is inconsistent: only 29% met their targets in 2024 (a sharp drop from 72% in 2023).

– Average return in 2024: 64% of CDI, equivalent to IPCA +2.19% (down from IPCA +6.17% in 2023).

– Bracket 1 posted the best performance (8.8%); Bracket 4, the worst (3.5%, below inflation).

– Portfolio allocation: predominance of fixed income not indexed to CDI (55%), low international diversification (less than 2%), and a near absence of impact investments.

– Larger funds are more sophisticated, but more exposed to volatility.

– Liquidity: 54% of assets can be converted within 30 days; larger funds lock in a higher share over longer horizons.

4. Responsible Investment

– Only 26% of funds have a fully implemented responsible investment policy.

– ESG integration is the most common practice (21 funds).

– Impact investing is nascent: 6 funds invest indirectly, 5 directly.

– Blended finance is almost non-existent (1 fund).

– Reasons for non-adoption: lack of priority (18 funds) and operational barriers (returns, lack of products, shortage of managers).

– Investment policy explicitly tied to the fund’s cause: only 13% apply such an approach; 23% report that there are no products aligned with their causes.

5. Governance

– Governance structures are widely adopted: Boards of Directors (73%), Investment Committees (67%), Audit Committees/Boards (65%).

– General assemblies: high average number of members (19.5), with the presence of independent members (84%), women (31%) and a still very low share of Black, Brown, and Indigenous people (PPI) (11%).

– Boards of Directors: strong independence (79%), women (37%), PPI (19%).

– Investment Committees: independence (78%), but low diversity (women 29%, PPI 31%).

– Audit Committees/Boards: independence (85%), women (44%), PPI (13%).

– Formalized investment policy in 77% of funds.

– Management models: predominance of in-house management (55%), while large funds rely more on external management (67%).

– External management is mostly non-discretionary (63%), keeping final decisions with the fund.

– External auditing is present in 70% of funds.

– Returns by management model: in 2024, in-house management outperformed external management (8.6% vs. 4.4%).

6. Outlook

– Fundraising in 2025: 51% expect an increase; optimism is concentrated among smaller funds.

– Disbursements in 2025: 44% expect to increase; 22% do not plan to disburse anything.

– Returns in 2025: 64% expect higher returns; only 1 fund forecasts a decline.

– Risk in 2025: 80% expect to maintain current risk levels; only 3% project an increase.

– Main challenges: fundraising (62%) is the dominant concern, especially for smaller funds. Larger funds are more concerned with returns, the regulatory environment, and strategic disbursements.

– Expectations vs. reality: the optimistic forecasts made in 2023 did not materialize in 2024.

– Fundraising: only 39% raised more or maintained levels, versus 78% expected.

– Disbursements: only 55% increased or maintained levels, versus 78% expected.

Download the full publication here (available in Portuguese only)

Note: values in US dollars were calculated using an approximate exchange rate of USD 1.00 = BRL 5.50 .