Originally published in Alliance Magazine on 06/06/2023

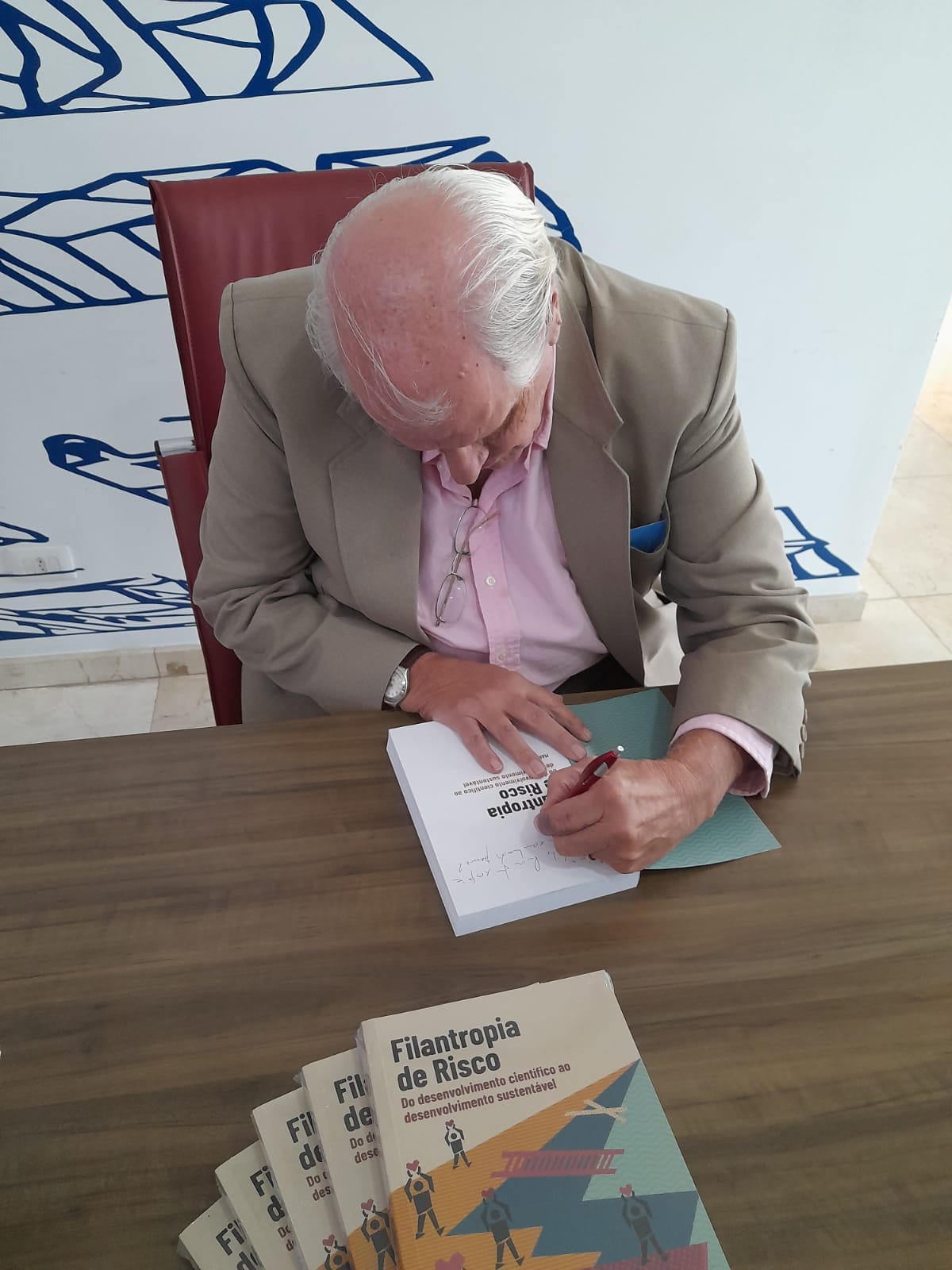

by Paulo Fabiani, CEO at IDIS, and Andrea Hanai, project manager at IDIS

A relatively new phenomenon on the Brazilian scene, endowment funds are strengthening social causes and organizations

With a long history behind them, endowment funds have become an effective mechanism for the sustainability of causes and organisations around the world. The first known example dates from the first century BCE, when Plato left his farm to support the Academy he had founded. Since then, many institutions have been establishing significant endowments, such as Harvard University, the University of Cambridge, and the Metropolitan Museum of Art. Wealthy families and individuals have also created endowments, such as Gates, Rockefeller, Mott, and others. In Brazil, the adoption of the mechanism is more recent, however, it has been expanding rapidly in this century, following the strengthening and maturity of the philanthropic environment.

The first endowments in Brazil emerged in the 1950s, as a way for families and businesses to build lasting legacies. In the absence of a specific regulation on the subject, they used the international experience as a reference to create their own governance, policies and rules to manage the endowment structures. Nevertheless, at first very few took this step, and by 2000, there were only six known endowments in the country.

In Brazil, the adoption of the mechanism is more recent, however, it has been expanding rapidly in this century, following the strengthening and maturity of the philanthropic environment.

A leap forward

However, in the following years, civil society organisations and families began to recognise the importance of endowment structures for the financial sustainability and perpetuity of their philanthropic activities, a trend which was accelerated by the work of IDIS (Institute for the Development of Social Investment) and other civil society actors to promote a better regulatory environment for endowments. A turning point was the disastrous fire at the National Museum in Rio de Janeiro in 2018, which led politicians to seek solutions to the lack of long-term financing for museums and other cultural institutions. In 2019, the endowment fund boom gained traction with the enactment of the first relevant law (Law 13.800/19), aimed at setting a regulatory baseline for the development of the endowment industry.

In the following years, civil society organisations and families began to recognise the importance of endowment structures for the financial sustainability and perpetuity of their philanthropic activities.

The legislation has contributed significantly to a more favourable environment, by ensuring visibility to the mechanism, and bringing attention to long-term strategies and sustainability. It has also established a framework, both legal and institutional, that engenders confidence in donors.

Moreover, the Law 13.800/19 has also ensured that public institutions of education, health and culture, among others, also benefit from these structures, regulating a mechanism that facilitates private donations and reduces dependence on already scarce public funds. In this context, the creation of endowments by public institutions that seek financial sustainability through an instrument that diversifies their sources of funds and increases their budgets is on the increase.

The Brazilian Endowments Outlook, published by IDIS in 2022, revealed for the first time the size and characteristics of the industry in the country. The study mapped 52 active endowment funds, 23 per cent of which were constituted after the enactment of the Law 13.800/19. Together, their patrimony totalled BRL 78.8 billion (approximately $14.3 billion). The most significant one is the endowment from Bradesco Foundation with assets equivalent to $11 billion, which puts it among the leading endowments not only in Brazil, but worldwide. Education is the chief beneficiary of this growing trend, supported by 24 Brazilian endowments, followed by culture (nine) and health (eight). Another sign of their growing popularity is that, according to the GIFE Census 2020, a survey among 131 corporate, family, and independent philanthropic Brazilian institutions, endowments were the source of 26 per cent of their budgets that year, corresponding to almost BRL 1.4 billion (approximately $300 million) in funds destined to causes and institutions, an amount which indicates the impact of endowments for the development of socio-environmental causes in the country.

The creation of endowments by public institutions that seek financial sustainability through an instrument that diversifies their sources of funds and increases their budgets is on the increase.

The challenges remaining

To explore endowments’ full potential, though, the philanthropic sector faces significant challenges: governance implementation, investment returns and fundraising capability are the main concerns. An emerging range of specialised consulting, legal and fundraising services, along with financial institutions and academic researchers, is now dedicated to supporting philanthropists, businesses, civil society organisations and public institutions in structuring their endowments. In another study, IDIS sheds light on the endowment financial performance and portfolio of investments to provide the sector with relevant benchmarking information.

Further advances in the regulatory environment for endowments are also needed. For example, despite being positive and innovative, the Brazilian endowment law does not foresee tax incentives for donors. The experience in countries like the US and the UK demonstrate that tax incentives create a fertile environment for the donations to such funds, resulting in large and long-standing endowments. In addition, the exemption from income tax on investment returns is not guaranteed by the Brazilian legislation, which cuts down endowments’ spending capability and the volume of resources destined for the causes and institutions supported by these funds.

In order to influence this environment, the Brazilian Endowment Coalition has been set up, a network that brings together 102 signatories and which urges tax incentives for donations and tax exemption of endowment funds as a way of accelerating the adoption of this mechanism and strengthening the philanthropic sector. Heading the coalition and supported by Brazilian donors and international organisations such as WINGS (with resources from the EU), IDIS reinforces its advocacy strategy by having regular communication with members of congress, monitoring bills, conducting studies and publishing case studies.

Notwithstanding the challenges, there is great potential and opportunity for endowments to flourish in Brazil. For the fourth consecutive year, Brazil rose in the overall ranking of the World Giving Index, jumping from 54th to 18th position, despite the difficulties arising from the socio-economic context and political turmoil of recent years. A giving culture is on the rise. As they become more popular, contributing to endowments provides another option for the exercise of citizenship and the promotion of socio-environmental equity and justice.