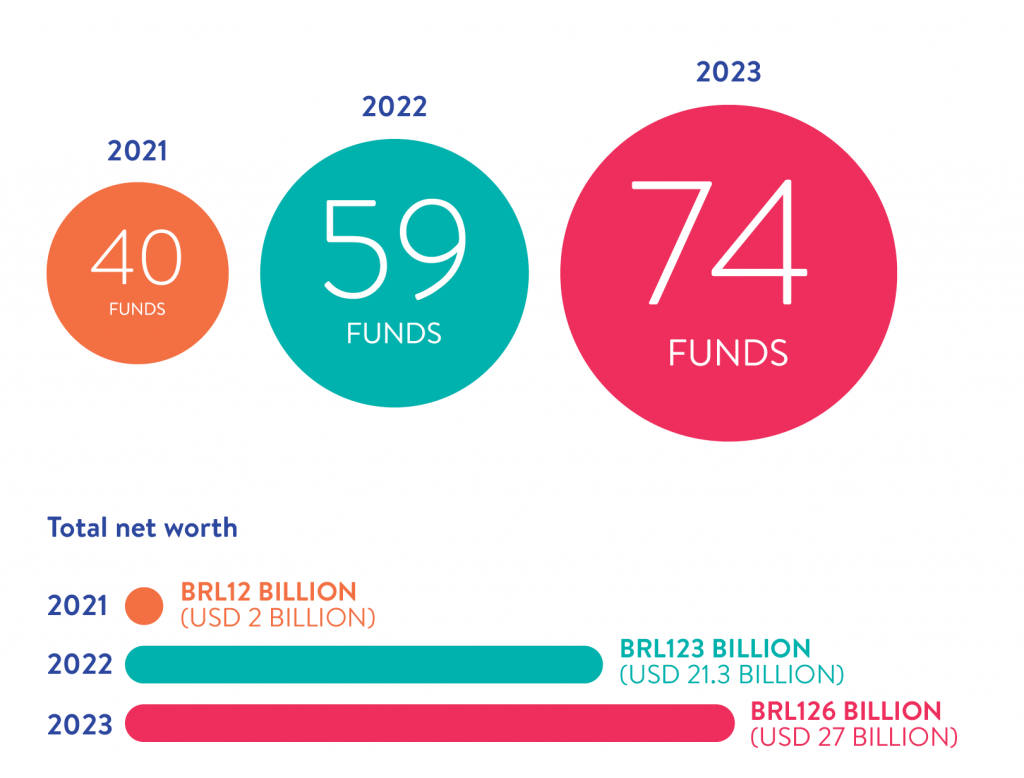

The discussion regarding the significance of endowments, as well as their legacy and enduring influence on socio-environmental initiatives, is gaining momentum in Brazil. In an edition that encompasses a historical series from 2019 to 2023, IDIS – Institute for the Development of Social Investment launches the 2023 Endowment Performance Yearbook, presenting a sample of 74 out of 107 eligible funds, which together total BRL156 billion in assets (around USD 26 billion).

Profile of the sample of endowment funds analized in the Endowment Performance Yearbook between 2021 and 2023.

The survey, aimed at endowment managers, reveals that in 2023 funds achieved an average return of 10.6%, the highest since 2020, and that most funds prefer investments in fixed income, cash and equivalents, categories that concentrated 81% of financial investments in endowment funds.

The publication’s foreword comes from Senator Flávio Arns, responsible for drafting Bill 2.440/23, created as a complement to Law 13.800/19 on Philanthropic Endowment Funds. Arns emphasizes that “endowment funds are essential for the social development of our country, as they promote projects and causes that transform the lives of Brazilians.”

According to the Monitor of Endowment Funds in Brazil, a project coordinated by IDIS, 115 Brazilian endowment funds have been mapped, and eight of these were created just this year. Endowment funds bring together a set of private assets with the aim of using income to provide long-term funding for the institutions and/or causes they support. In other words, the creation of an endowment fund perpetuates in the work of an institution or in support of a cause.

The Endowment Performance Yearbook provides a panorama of information on cash flow, allocation, returns, investment policy and the governance of endowments. According to the publication, R$3.5 billion was redeemed in 2023 alone, of which R$3.2 billion (around USD 550 million) was allocated for causes and R$270 million (USD 46.6 millions) was destined for expenses.

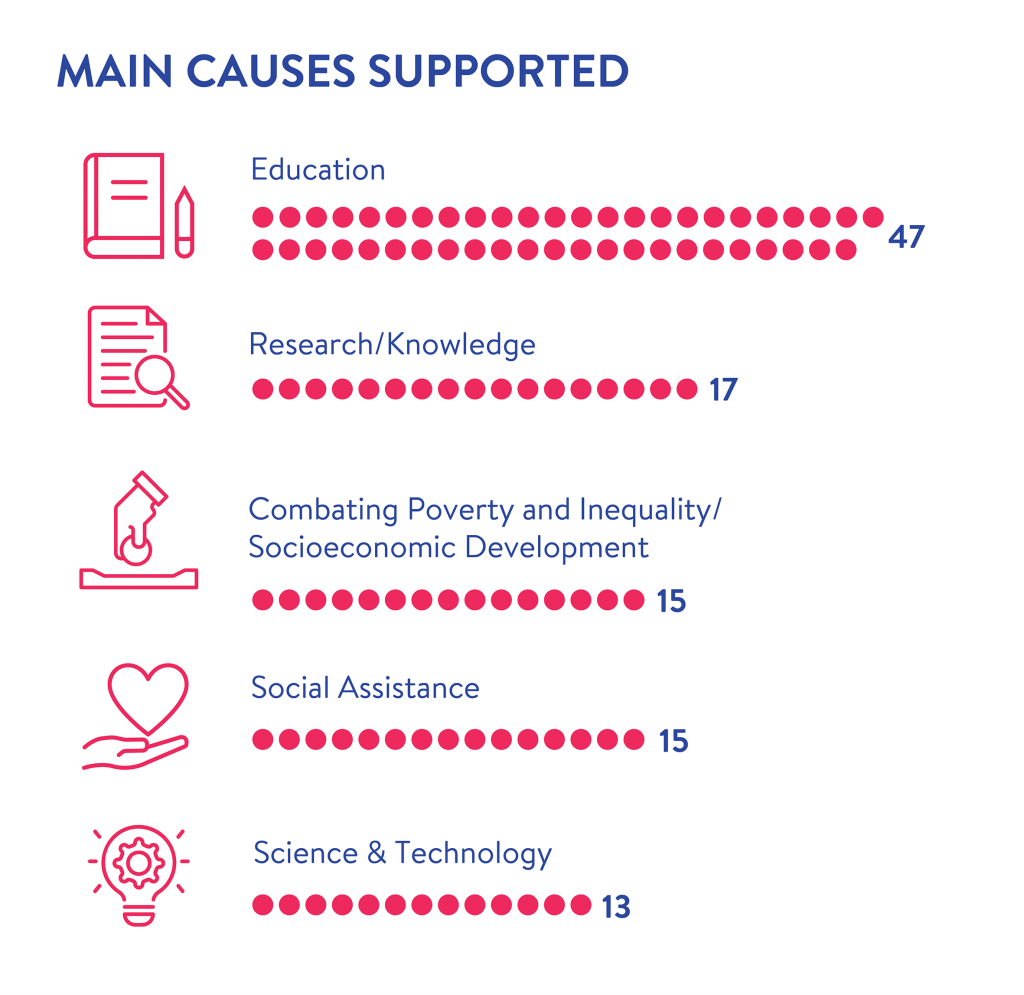

Five main causes supported by endowments analyzed by the Endowment Performance Yearbook 2023.

Education continues to be the cause that receives greatest support with 47 funds allocated to the sector. This was followed by research and knowledge, inequality/ economic and social development and social assistance. Most of the funds are concentrated along the Rio-São Paulo axis, with São Paulo accounting for 69% of the total number of participants in the survey.

“The Yearbook presents parameters and references for the work of managers. Now in its third edition, the publication is recognized as a guide for decision-making and has been fundamental to our advocacy actions in search of improved public policies in Brazil,” states Paula Fabiani, CEO of IDIS.

Regarding the number of donations received, in 2023, the 74 endowments received a total of BRL 517 million in donations, but the average amount granted per fund remained stable, dropping slightly from BRL 9.3 million in 2022 to BRL 8.8 million in 2023. Also noteworthy is the concentration of donations in just a few funds, confirmed in this edition by the fact that the five funds most engaged in fundraising received 75% of the donations. It’s no surprise, then, that fundraising continues to be the biggest challenge facing managers, especially those responsible for funds with assets of less than BRL500 million.

Another discovery revealed by the survey concerns the low ethnic and racial diversity in governance bodies. Representation from the black, brown and indigenous population on councils and committees is very low and did not exceed 8% of the members in any of the cases analyzed. The information presented in the publication was collected through an online questionnaire, answered directly by the managers of the equity funds.

Check out the full launch event (available only in portuguese):

Main findings of the publication

Bringing together five years’ worth of data (2019 to 2023), the survey confirms trends among several of the points presented and also highlights new developments.

Total donations to endowment funds have grown, but the average remains stable

For the second year running, the total volume of donations to endowment funds has grown. In 2023, the endowments received BRL517 million. Yet this increase may have been caused by the larger sample, since the average amount donated to each one remained stable, with a slight drop, from BRL 9.3 million in 2022 to BRL 8.8 million in 2023.

Assets grow fueled by donations

Between 2022 and 2023, the funds in the sample saw their assets increase by an average of 37.6%, a much higher percentage than the average rate of return, which indicates that the growth is largely due to donations.

The biggest slice of donations goes to a small group

The tendency for donations to be concentrated in a few funds is confirmed in this edition. The top five funds received 75% of the donations. This percentage is very close to that of the previous edition, which was 74%.

Endowment funds contributed BRL 3.2 billion to causes in 2023

The total redemption volume reached the expressive number of BRL 3.5 billion, driven by large funds (with assets of over BRL 500 million) which accounted for 90% of withdrawals. Of the total amount redeemed, BRL 3.2 billion was earmarked for the causes and BRL 270 million was used to finance the funds.

The Rio-São Paulo axis still dominates endowments

More than 80% of the endowment funds analyzed are based in the states of São Paulo and Rio de Janeiro, with São Paulo alone accounting for 69% of the sample. However, there are representatives from all regions of Brazil in the sample, encompassing 11 states.

Adherence to the Endowment funds Law model is still low

Only 19% of funds operate within the parameters established by Law 13.800/19, known as the Endowment Funds Law. The main reasons for not adhering are the lack of tax incentives and complex governance, both of which were cited by 13% of respondents. Taking into consideration that 70% of the organizations managing the funds in the sample enjoy immunity or exemption from taxes, not adopting the Law’s model could also be linked to a fear of losing their tax status.

Education remains the favorite cause

Education remains at the top of the ranking of favorite causes, with 47 endowment funds in support. Also among the top five are Research/Knowledge (2nd place) and Science and Technology (5th place), two causes also tied to Education. The third and fourth places are occupied by Combating poverty and inequality/economic and social development; and Social Care, both of which each receive support from 15 funds.

NEW ISSUE

Endowments contribute little to the funding sources of supported institutions

Among endowments created for the benefit of the managing organization itself, half contribute less than 10% of the funding sources of the supported institution, while 25% account for all funding. Among the funds that serve an institution other than the managing organization, 96% contribute with less than 10% of the supported institution’s sources of funding.

Portfolio allocation prioritizes fixed income and liquidity

The data confirms fund managers’ preference for fixed income, cash and cash equivalents. These categories concentrated 81% of the financial investments of endowment funds in 2023, maintaining a more or less stable level over the last five years, and giving the portfolio a high degree of liquidity, since 53% of the investments can be redeemed within 30 days.

Average return of 10.6%, the highest since 2020

The average return on the funds in the sample in 2023 was around 10%, with no major variations between the different asset sizes. This is the best figure since 2020, surpassing IPCA by more than 5 percentage points (4.62%), but around 3 percentage points below the CDI (13.04%).

Achievement of return targets in 2023 has the highest percentage in the period analyzed

Of the sample of 74 funds, only 43% adopt a return target. Among them, the IPCA + 5% is the most common target. In 2023, 66% of them achieved their goals, the highest percentage in the period analyzed by the Yearbook.

In-house financial management remains the preferred model for managers

Almost two-thirds of funds (63%) practice exclusively in-house financial management, and this model is more common among those with lower assets.

Funds with external financial management performed better in 2023

Contrary to the experience in 2021 and 2022, when the scenario of rising interest rates benefited the more conservative investment options usually preferred by in-house managers, in 2023, funds that adopted exclusively external management, or even those that adopt both management models combined, showed superior returns, far exceeding the IPCA and almost touching the CDI.

Responsible investment policy is more intention than practice

Only 23% of the funds in the sample adopt a responsible investment policy and implement it. Seven percent declare they follow the policy but admit that it is not yet taken into account across all decisions. Of those that do not have a responsible investment policy, two-thirds say they have plans to implement one.

Most funds have well-structured governance

Most of the funds analyzed have well-organized governance, 78% have Advisory Boards, 66% feature Fiscal Boards and 62% have Investment Committees.

Women are present in governance bodies, but in low numbers

Opening space to a variety of genders on boards and committees is a reality for most endowment funds. Women are represented in 83% of the general meetings, in 90% of the boards of directors, in 74% of the investment committees and in 60% of the supervisory boards. However, when the total number of women is compared to the number of men, we see that women don’t even occupy half of the seats and, in the case of investment boards, account for only 7% of members.

NEW CHALLENGES

Ethnic and racial diversity in governance continues to present a challenge

While women have already managed to win seats on most councils and committees, this continues to be a distant reality for the black, brown and indigenous population (BIPOC). They are represented in 43% of the general meetings, in 36% of the boards of directors, in 11% of the investment committees. However, the BIPOC presence is numerically very low and in none of the instances does it exceed 8% of members.

Fundraising continues to be the principal challenge

The greatest concern for equity fund managers continues to be fundraising, except for those with more than BRL 500 million in assets, for whom profitability is the main challenge. Profitability is also a concern for other funds, almost always appearing in second place, except for foundations with assets of up to BRL 10 million, which cite their own consolidation as the second-biggest challenge.

Managers expect to receive more donations in 2024

When asked about the outlook for 2024, more than half (56%) expected to raise more funds, and 41% said they expected an increase in the amount allocated to causes. Managers were more conservative on investment performance, with 38% forecasting an increase in gross profitability in 2024 and nearly half (48%) expecting last year’s figures to be repeated. But few were willing to risk pursuing profitability, as 88% of managers stated that the portfolio continues to present the same level of risk as in 2023.

Audience at the celebration in the MASP auditorium. Credit: Paula Miranda.

Audience at the celebration in the MASP auditorium. Credit: Paula Miranda.

Afterwards, a tribute was then paid to

Afterwards, a tribute was then paid to